The Future of LiDAR and Security

Radar love? Yesterday’s news. Sonar? So out. LiDAR is the new heartthrob of the remote sensing world, in smart cities, surveillance, autonomous vehicles, intrusion detection and other applications.

With MEMS devices, a single sensor is pointed at a tiny, quickly spinning mirror, which can be moved to capture the desired field. MEMS was represented at CES by Blickfeld.

Photo courtesy of Blickfeld

Postmates’ autonomous delivery robot relies on lidar sensors from Ouster, a startup that recently raised $60 million in equity and debt funding. Postmates unveiled the first generation of its “autonomous rover” — known as Serve — late last year. The vehicle uses cameras and liDAR to navigate sidewalks, as well as a backup human who remotely monitors the rover and can take control if needed.

Photo courtesy of Ouster

AEye is an automotive LiDAR company that is exploring security collaborations.

Photo courtesy of AEye

SensePhotonics' Sense One solution is for industrial applications, which promises up to 40 meters of range outdoors for imaging large workspaces or perimeters, 7.5x higher vertical resolution than other sensors and a 2.5x wider vertical field of view (75 degrees compared to 30 degrees).

Photo courtesy of SensePhotonics

The LiDAR age is here, and its developers were out in force at January’s Consumer Electronics Show (CES) in Las Vegas, Nev.

LiDAR vendors gobbled up thousands of square feet to portray the world of smart cities with LiDAR sensors on robo-taxis, self-driving trucks, delivery drones, parking garages, mass transit, traffic lights and utility poles.

But is the tech ready for mainstream security use?

Forecasts paint a rosy picture. Grand View Research recently projected that the global LiDAR market will soar from $1.1B in 2018 to $2.9B in 2025, an almost 18-percent compound annual growth rate (CAGR). Inkwood Research predicts a 23-percent CAGR in roughly the same time period, noting that “the important driver increasing growth in the global LiDAR technology market is the demand for stronger security and sensor accuracy….LiDAR plays a significant role in homeland defense and national security and for an increasing number of applications which depend on timely, accurate geospatial data to support the decision-making process.”

LiDAR has the advantages of creating high-resolution 3D images that identify the size, direction and velocity of objects in the field of view. Better yet, it works in all lighting and atmospheric conditions. And it’s hard to hack or fool. That’s an attractive proposition.

Not so fast, say security consultants and integrators. While the technology is indeed attractive and falling in price, LiDAR still remains a niche or high-security application because of the high cost of sensors compared to alternative technologies. Here is the latest on how advances in automotive LiDAR are influencing security applications.

LiDAR Technology

LiDAR technology resembles radar and sonar in that all three identify objects, their sizes and contours, and their direction over time by sending out waves, timing how long the waves take to bounce back, and reading these reflections. This is referred to as a “time-of-flight” approach, an industry standard. (However, a promising approach called frequency modulated continuous wave, a technique used by automotive radar, is starting to appear.) LiDAR uses laser light pulses, versus radar’s radio waves and sonar’s sound waves.

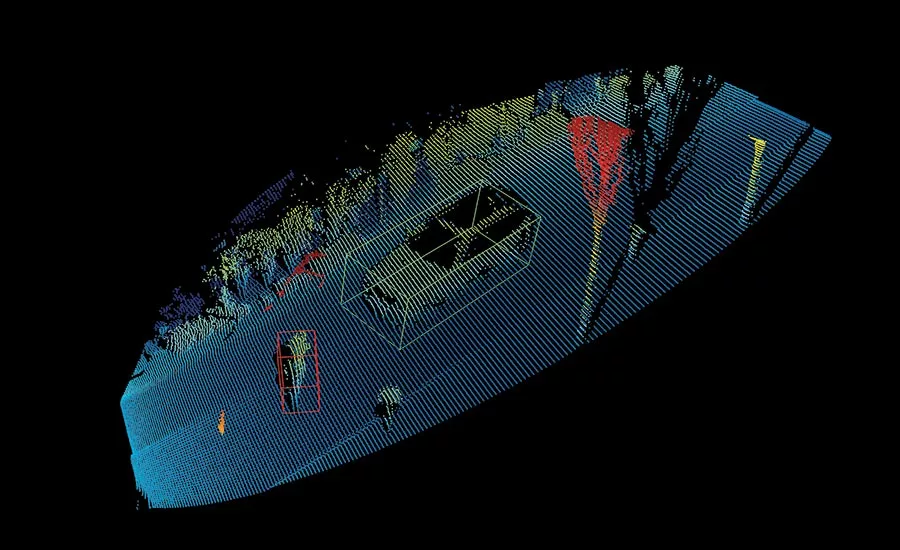

All 3D LiDAR technologies create three-dimensional point clouds that represent shapes and features, such as vehicles, buildings and people. But several options exist.

Spinning LiDAR. Best identified by the telltale dome on the roof of a connected car, spinning systems have been the prevailing form of the technology. According to technical publication Ars Technica, “Velodyne created the modern LiDAR industry around 2007 when it introduced a LiDAR unit that stacked 64 lasers in a vertical column and spun the whole thing around many times per second.” Rotating LiDAR captures a wide field of view and a long range, but its components tend to be heavy and expensive, and the moving parts require regular maintenance.

Damon Lavrinc of Ouster, another spinning LiDAR company, says that while spinning/mechanical systems are still the gold standard, the trend is from moving parts to silicon. “We’re taking all of old components used by legacy LiDAR companies and distilling them onto chips,” he says. And Moore’s Law is taking hold in LiDAR. In just a couple of years they moved from 16 to 32 to 64 beams of light, meaning a doubling of resolution at each increase. “And at CES, we introduced 128, the highest resolution possible.”

Quanergy, of Sunnyvale, Calif., also makes a spinning product. According to Chief Marketing Officer Enzo Signore, although the company is innovating with optical arrays in high-end applications, Signore says spinning LiDAR, used in its M8 sensor, typically suits security applications. That product, he says, has a 360-degree horizontal field of view and generates 1.3 million pulses per second in the point cloud. Paired with its Qortex machine learning software, Signore says that its solution is designed to classify people and vehicles, such as identifying how many people are at an airport security checkpoint. A pharmaceutical client, for example, uses it along a 400 meter fence line at a storage facility, having rejected radar due to interference issues and on-fence motion sensors due to high winds. “If an intruder is, say, 70 meters away, the LiDAR will see that person and assign an ID to that person and we can track him all around,” Signore says. “If he then enters a forbidden zone, such as too near an electric switch, you can point a camera at him.”

But spinning technology is giving way to solid-state products: chip-based solutions without moving parts (or with miniscule moving parts). And companies are pouring research into solid-state options such as micro-electromagnetic systems (MEMS), flash LiDAR and phased arrays.

MEMS. With MEMS devices, a single sensor is pointed at a tiny, quickly spinning mirror, which can be moved to capture the desired field. MEMS was represented at CES by such companies as Luminar, AEye, Innoviz, LeiShen Intellligent System, ZVision and Blickfeld. MEMS advocates cite cheaper cost and reduced wear and tear compared to spinning LiDAR, but MEMS’ small mirrors limit their range and field of view.

Representatives of MEMS companies say that the race to create affordable automotive-grade sensors – which must process swarms of data from all directions instantaneously – will benefit security-grade LiDAR, but it’s still early. Akram Benmbarek, VP of Business Development and Strategic Initiatives at AEye, says that his company is focusing on long-range detection, amplifiable range and high resolution at the edge. The smart city/urban mobility market is so great that the company has deprioritized security applications. Because of the cost, “the most suitable customers for security applications today are critical infrastructures and government agencies,” Benmbarek says. “They have the most at stake and to protect, and they require redundancy in intrusion detection.”

AEye, based in Dublin, Calif., says that its “agile LiDAR” scans, collects and processes data intelligently, with a range of more than 300 meters, well beyond most other companies’ range. Benmbarek claims that the technology can “dynamically adapt its scanning patterns to focus on ‘regions of interest’ in a single frame, enabling it to identify objects 10 to 20 times more than LiDAR-only products.”

Dr. Florian Petit, one of the founders of Blickfeld, a Munich-based LiDAR firm, says that his company has developed a special mirror that significantly increases range and field of view. That advance, from its autonomous vehicle work, is being applied to its sensors for industrial security, he says. Customers are using this technology for perimeter protection and intrusion detection. “We can detect where a person is and where he is moving,” Petit says. “LiDAR can look along a fence line and identify intruders who might be climbing a fence,” he says.

Behind the Metrics

Check out the specs of any LiDAR product and it’s easy to be overwhelmed: Detection range at reflectivity rates, vertical and horizontal resolution, points per second, laser wavelength, angular accuracy, beam divergence, field of view coverage and so on. It’s extremely difficult to compare this dizzying amount of information on its face. As with every security setup, the data is only useful when you understand the application.

Palo Alto-based Luminar has a mechanical solution that it says “uses a non-MEMS technique to a move a larger mirror to aim the laser beam and receive the light scattered off the objects in the field,” according to spokesperson Erin Freeley. This helps detect and classify objects out to 250 meters. And while most LiDARs use 905 nm lasers (partly for eye safety concerns), Luminar uses a 1550 nm laser (as does AEye), which allows the sensors to see further or create more resolution.

Flash LiDAR. According to An Introduction to Automotive LiDAR published by Texas Instruments, Flash LiDAR works like digital camera using an optical flash, capturing backscattered light. This method is less prone to image vibration and produces a much faster data capture rate. Texas Instruments notes two downsides, however. For one, reflected light blinds sensors. In addition, great power is necessary to light a scene, especially at distance. Most flash LiDAR, made by manufacturers such as Continental Automotive and LeddarTech, is being applied to autonomous vehicles.

Sense Photonics, of Durham, N.C., is an exception. According to Erin Bishop, director of business development, SensePhotonics has a solution – Sense One – for industrial applications, which promises up to 40 meters of range outdoors for imaging large workspaces or perimeters, 7.5x higher vertical resolution than other sensors and a 2.5x wider vertical field of view (75 degrees compared to 30 degrees).

Phased arrays. As Ars Technica explains, “a phased array is a row of transmitters that can change the direction of an electromagnetic beam by adjusting the relative phase of the signal from one transmitter to the next.” Quanergy is one of the few companies to use this approach, having just introduced its S3-2 sensor for facility access control and people counting.

Still Camera Shy

Security consultants, integrators and even some LiDAR manufacturers touted the advantages of LiDAR but say it’s still not ready for mainstream use. “Cameras, radar and sonar still cost much less than LiDAR units off of shelf,” acknowledges Tim Leckey of ZVision, a Beijing-based company that builds MEMS LiDAR for automotive uses. “Once we start getting automotive volumes going, it will drive prices down” for all LiDAR, he says. Ouster’s Lavrinc agrees that the infusion of money and research into automotive LiDAR will make sensors lighter and cheaper, “yielding a peace benefit” for security applications.

Of the dozens of sensors reviewed for this article, even the cheapest models sold for security uses range between $500 and $1,000. Spinning models with superior range and resolution start around $3,500. Prices soar from there.

“It’s an emerging technology that really hasn’t been utilized except in specialized applications,” says Mark Schreiber, president at Safeguards Consulting. Convergint Technologies’ Darin Dillon agrees: he has compared LiDAR with radar and other technologies for intrusion detection, but the sensors are “downright expensive,” he says. “Most everything was $1,500 to $15,000 per sensor.”

But it has significant upside. Its main advantage is that “it brings a high level of detail to a physical environment that we don’t have in other sensors,” Schreiber notes, comparing it to crisp color video versus grainy black and white footage. And Kelly Watt, a LiDAR expert and CEO of Visual Plan Security, is more optimistic about viability: “Sensors are becoming much more affordable. It does present opportunities in security for sure.”

Schreiber says LiDAR is well-suited for intrusion detection and surveillance. “You can know exactly when something has moved or changed, such as when someone has entered a zone or door,” he says. “If deployed properly, it can give you a physical measurement of an object a person.” One promising application would be to keep people away from delicate pieces in an art museum, he says.

Partnerships

As has started to occur, successful LiDAR companies will team with security companies that know the market, Schreiber says. Quanergy works with Milestone and Genetec. San Jose-based LiDAR maker Cepton has joined forces with CNL Software, which manufactures physical security information management platform software. Velodyne works with security partners in Dubai, the Czech Republic and South Korea. And AEye and ZVision are among automotive LiDAR companies that are exploring security collaborations. “You’re not going to create a whole new system based on LiDAR,” he says. LiDAR has to suit the right application and be integrated among a suite of other technologies, Schreiber says.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!