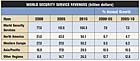

Global Security Service Revenues to Exceed $160 Billion in 2010

The global market for private contract security services is projected to advance 7.3 percent annually through 2010, surpassing $160 billion. While building construction—especially in North America, China and Eastern Europe—is expected to decelerate from an impressive 2000-2005 performance, a firming global economy and rising urbanization will continue to drive demand. Also important will be heightened fears of domestic crime and terrorism in many countries, and recovery in the global travel and tourism industries. Further advances will be limited by rising competition from electronic security measures such as security video and access controls, which reduce the need for human guards, and by intense price competition in the guard and armored transport segments. These and other trends are presented in World Security Services, a new study from The Freedonia Group, Inc., a Cleveland-based industry market research firm.

Contract guarding will remain the largest segment of the market, accounting for over 40 percent of total revenues. Favorable prospects exist for central station alarm monitoring (especially in the less tapped residential and small business segments), as well as for services such as systems integration and consulting, which benefit from the transition from manned to electronic security modalities. By contrast, the private prison management industry has suffered a dramatic reversal of fortunes since the late 1990s, as rising opposition to the privatization of correctional facilities has taken it from the fastest to one of the slowest growing security service segments. Indeed, prison management contracts with private firms have been revoked in countries from Canada to New Zealand, with the state resuming control.

The U.S. will remain the largest single consumer of private contract security services, accounting for 30 percent of total world demand. However, advances will trail the global average by a wide margin as the housing market cools and alarm monitoring markets mature. By contrast, double-digit annual gains are anticipated in the world’s developing regions—Asia, Latin America, Eastern Europe, Africa and the Middle East. China and India jointly account for less than two percent of the global market, but will log some of the fastest gains through 2015. Over the intermediate term, Chinese demand will be stoked by the opening of the Chinese market to broader foreign participation in 2007 and by preparations to host a series of major international events.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!